How to Transition from Personal to Commercial Auto Insurance Legally

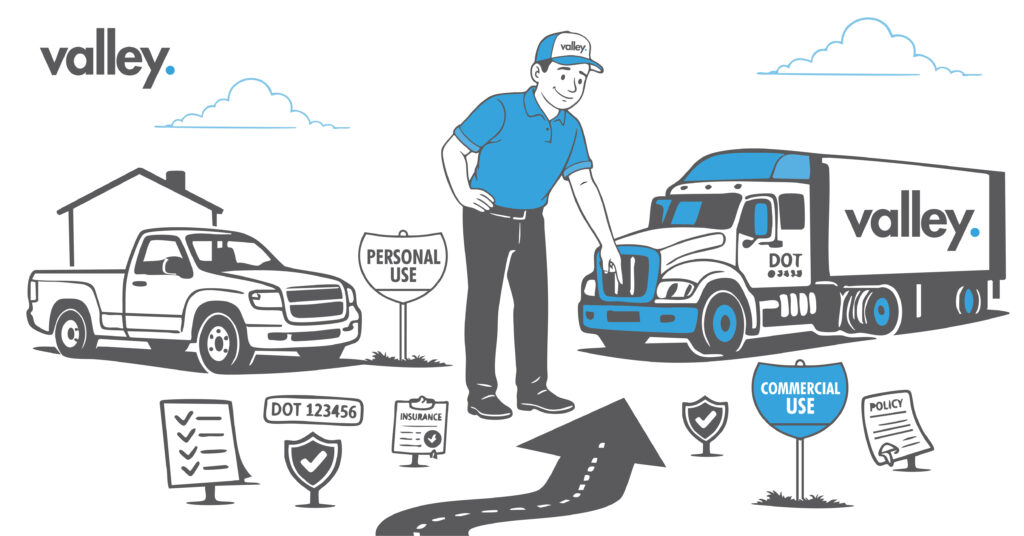

Many drivers start with personal auto insurance and later move into trucking or delivery work. The transition sounds simple, but it is one of the most common compliance mistakes new carriers make. Using personal auto insurance for commercial activity can void coverage, trigger fines, and leave drivers personally responsible for accidents.

The truth is this. Once you use a vehicle for business purposes beyond limited personal use, personal auto insurance is no longer enough. Making the switch to commercial auto insurance the right way protects your finances, keeps you legal, and prevents serious problems with insurers and regulators.

This guide explains when personal auto insurance stops being valid, how to transition to commercial coverage legally, what regulators require, and how to avoid common mistakes during the process.

Quick Answer

You must transition from personal to commercial auto insurance when a vehicle is used for business activities such as hauling freight, transporting goods for pay, or operating under a DOT number. The legal transition involves updating vehicle use classification, securing a commercial auto policy, filing required forms with regulators, and confirming coverage before operating. Running commercial work under personal insurance can result in denied claims, fines, and loss of authority.

Why Personal Auto Insurance Is Not Enough

Personal auto insurance is designed for private use. It covers commuting, errands, and personal travel. The moment a vehicle is used to generate income, risk changes.

Business Use Changes Liability

Commercial driving increases exposure. Longer hours, heavier loads, and public interaction raise accident risk. Insurers price personal policies assuming lower exposure.

Personal Policies Exclude Commercial Activity

Most personal auto policies exclude coverage for transporting goods for pay or using the vehicle as part of a business. If an accident happens during commercial use, the insurer can deny the claim.

Regulators Require Proof of Commercial Coverage

Once a driver operates commercially, proof of insurance must meet specific legal standards. Personal policies do not meet those standards.

The National Association of Insurance Commissioners explains the difference between personal and commercial auto coverage and why using the wrong policy creates gaps. Their consumer guidance is available through the NAIC insurance resource.

When You Are Legally Required to Switch

Understanding the trigger points helps drivers avoid accidental violations.

You Are Hauling Freight for Pay

The moment you transport goods for compensation, you are operating commercially. This applies to owner operators, independent contractors, and fleet drivers.

You Operate Under a DOT Number

Any vehicle operating under a DOT number requires commercial auto insurance. This applies even if the vehicle looks like a personal pickup or van.

You Use the Vehicle for Business Purposes Regularly

Repeated deliveries, service calls, or client transportation usually require commercial coverage.

You Carry Business Branding or Equipment

Logos, signage, or permanently installed equipment can signal commercial use to insurers and enforcement officers.

You Cross State Lines for Work

Interstate commerce brings federal requirements that personal policies cannot satisfy.

The FMCSA outlines insurance requirements for commercial carriers and when proof of coverage is mandatory. Their guidance is available at the FMCSA insurance requirements page.

What Happens If You Do Not Switch Properly

The consequences of operating commercially under personal insurance are serious.

Claims Can Be Denied

If an accident occurs during commercial activity, the insurer can deny coverage entirely. That leaves the driver responsible for damages, injuries, and legal costs.

You May Face Fines or Penalties

State and federal authorities can issue fines for operating without proper insurance.

Vehicles Can Be Taken Out of Service

Inspectors may place a vehicle out of service until proper coverage is shown.

Future Insurance Becomes More Expensive

Insurers view improper coverage as a compliance failure. This often leads to higher premiums later.

Personal Assets Are at Risk

Without valid coverage, personal savings, property, and income can be exposed in lawsuits.

Step by Step: How to Transition Legally

Making the switch the right way protects your operation and prevents downtime.

Step 1: Confirm Your Business Use

Be honest about how the vehicle is used. This includes:

- Cargo type

- Operating radius

- Mileage

- Driver status

- Frequency of commercial use

Insurers price policies based on this information.

Step 2: Choose the Correct Commercial Policy

Commercial auto insurance comes in different forms.

For Owner Operators

Policies typically include liability, physical damage, and optional cargo coverage.

For Fleets

Coverage must account for multiple vehicles, drivers, and operational complexity.

For Mixed Use Vehicles

Some insurers offer policies that cover limited personal use alongside commercial activity.

Make sure the policy matches actual operations.

Step 3: Secure Coverage Before Operating

Never run a load assuming coverage will start later. Commercial policies must be active before business use begins.

Step 4: File Required Forms

Certain commercial operations require insurance filings with regulators.

- Federal filings for interstate carriers

- State filings where required

Your insurer or broker typically submits these, but you should confirm completion.

Step 5: Update Vehicle Registration if Needed

Some states require vehicles used commercially to be registered differently than personal vehicles.

Step 6: Notify Relevant Parties

Inform brokers, shippers, or contractors once commercial coverage is active. This prevents booking issues.

Step 7: Cancel or Adjust Personal Policy

Once commercial coverage is active, update or cancel the personal policy to avoid overlapping costs.

Common Mistakes During the Transition

Many drivers create problems by rushing or skipping steps.

Running Loads Before Coverage Is Active

This is one of the most common errors. Even one load without coverage creates serious exposure.

Underreporting Business Use

Trying to lower premiums by minimizing usage details often leads to denied claims.

Assuming Rideshare or Endorsements Are Enough

Endorsements on personal policies rarely cover true commercial hauling.

Forgetting to Update Coverage After Growth

New routes, heavier loads, or additional drivers require policy updates.

Not Reviewing Policy Exclusions

Exclusions matter. Understand what is not covered.

How Insurers Evaluate the Transition

Insurers look for stability and honesty.

Clean Documentation

Clear records help underwriting.

Accurate Use Descriptions

Matching policy details to real operations reduces disputes.

Compliance History

Past lapses or misclassification raise risk flags.

Claims Transparency

Prompt reporting builds trust.

The Insurance Information Institute explains how proper classification affects coverage and claims outcomes in their overview of commercial auto insurance at the Insurance Information Institute.

Real World Examples

The Owner Operator Who Waited Too Long

A driver accepted commercial loads under personal insurance while waiting for a quote. A minor accident occurred during a delivery. The claim was denied. The driver paid out of pocket and faced higher rates afterward.

The Contractor Who Switched Correctly

Another driver paused operations, secured commercial coverage, filed required forms, and then resumed hauling. When an accident happened later, the claim was handled smoothly.

The Mixed Use Confusion

A delivery driver used the same van for personal errands and business deliveries. After clarifying usage and switching to a commercial policy that allowed limited personal use, coverage gaps were eliminated.

How to Control Costs During the Switch

Commercial insurance costs more than personal coverage, but smart planning helps.

Improve Safety Records

Clean driving history lowers premiums.

Choose Appropriate Limits

Avoid over or under insuring.

Use Telematics if Available

Data supports better pricing.

Review Coverage Annually

Adjust as operations evolve.

Work With Knowledgeable Advisors

Experienced brokers help match policies to needs.

FAQs

Can I haul one load under personal insurance?

- No. Any commercial hauling requires proper coverage.

Is a pickup truck considered commercial?

- Yes, if it is used for business purposes.

Can insurance be backdated?

- No. Coverage starts when the policy is active.

Do I need commercial insurance if I am leased on?

- Usually yes. Requirements vary by contract.

Will switching increase my premiums?

- Yes, but it prevents much larger losses.

Final Thoughts

Transitioning from personal to commercial auto insurance is not optional. It is a legal and financial necessity for anyone using a vehicle to earn income. The risks of operating under the wrong policy far outweigh the cost of proper coverage.

Drivers who make the switch correctly protect their business, their personal assets, and their future insurability. The key is honesty, preparation, and timing.

If you are using a vehicle for business, review your insurance today. Confirm how your policy classifies your use and talk with a professional before you operate. Making the switch the right way keeps you legal and protected.

Smarter Coverage. Real Support. No Hassle.